Limited Liability Partnership (LLP) is a hybrid business structure that combines the features of both traditional partnership (partner-managed) and private Sdn. Bhd. company (namely-separate entity and limited liability). This structure was introduced in Malaysia on 26 December 2012, following the enforcement of the Limited Liability Partnerships Act 2012 (LLP Act)

Many entrepreneurs are drawn to LLPs because they offer lower operating costs—primarily due to the absence of mandatory audited financial statements—and because partners can act as the compliance officer, reducing the need to engage external professionals.

However, because of these perceived benefits, many LLPs are registered hastily, and over time some are abandoned or neglected. This often leads to partners being blacklisted and receiving compounds from SSM and LHDN for non-compliance. In this article, we focus on the available methods to close your LLP in Malaysia.

This article explains the available options to close an LLP in Malaysia and provides clarity on the most practical method.

Three Methods to Dissolve an LLP in Malaysia

Under the LLP Act, an LLP may be dissolved through three mechanisms. The appropriate method depends on its availability, LLP’s solvency, operational status, and compliance record.

| Method | Legal Provision | Initiated By | Key Condition |

| (i) Voluntary Winding-Up (Declaration of Dissolution) | Section 50 of the LLP Act | The Partners | The LLP is solvent, has ceased operations. |

| (ii) Winding-Up by the Court | Section 49 of the LLP Act | Partner, Creditor, or SSM | The LLP is insolvent, involved in disputes, or has acted unlawfully. |

| (iii) Striking-Off by the Registrar | Section 51 of the LLP Act | The Registrar (SSM) | The LLP is inactive or non-compliant (reserved for SSM action). |

Voluntary Winding-Up: The Practical Approach

For LLPs that are solvent (can pay all debts) and have officially ceased trading, the Voluntary Winding-Up (Declaration of Dissolution) is the most common and effective route.

Important to note, unlike Sdn. Bhd. company, partners cannot apply for Striking-Off. This power is reserved for the Registrar (SSM) under Section 51 of the LLP Act, and SSM has confirmed that no partner-initiated application guidelines are currently available:

“S.51 of the LLP Act 2012 Power of Registrar to strike-off limited liability partnerships from the register is reserved for the Registrar. There is no guideline issued for application to strike-off LLP. Thus, no application is allowed under this provision.”

Therefore, the following guide details the Voluntary Winding-Up process under Section 50 of the LLP Act.

Voluntary Winding-Up: The Step-by-Step Process (Section 50 of the LLP Act)

For an LLP that has ceased operations and settled all its financial obligations, the Voluntary Winding-Up (Declaration of Dissolution) is the most appropriate and straightforward method.

Step 1: Preliminary Requirements (Pre-Conditions)

The compliance officer of the LLP must ensure the following pre-condotions are met before the application can proceed:

- The LLP must have ceased to operate (must be dormant).

- The LLP must have discharged all its debts and liabilities. This includes loans, trade payables, employee benefits, and crucially, all tax liabilities.

- All assets must be disposed of and any surplus funds distributed to the partners.

- All statutory filings, including annual declarations to SSM, are up-to-date, including the final year of assessment.

Step 2: Obtaining Tax Clearance from LHDN

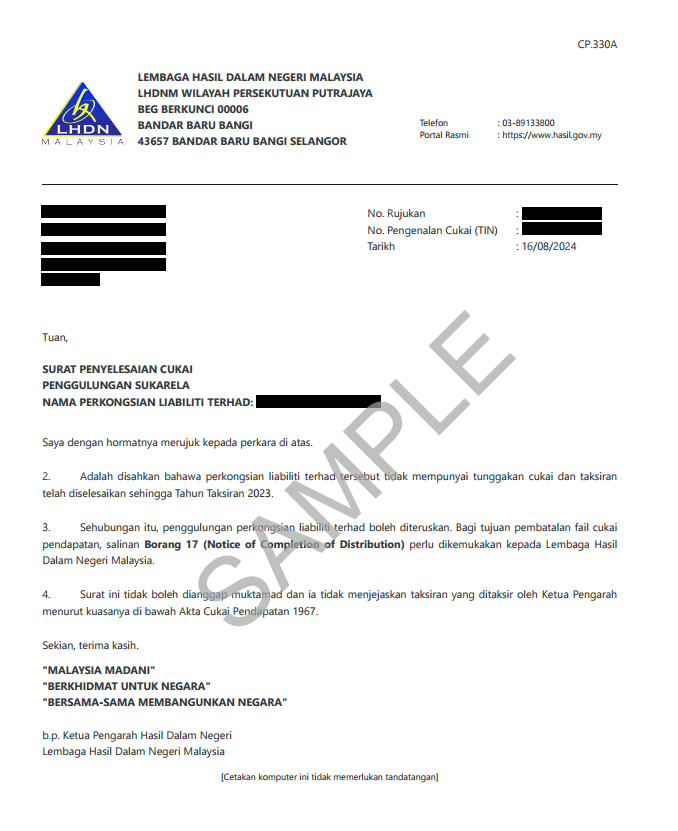

This is the most critical and time-consuming step. The LLP must secure a written No-Objection Notice (Surat Penyelesaian Cukai – Penggulungan Sukarela) from the Inland Revenue Board of Malaysia (LHDN) to prove all tax matters are settled.

| No. | Form/Document | Purpose | Key Action Points |

|---|---|---|---|

| I | Form CP7(PT) | Application for Tax Clearance Letter (Surat Penyelesaian Cukai – SPC) for an LLP. | This form must be completed by the Compliance Officer/Partner. |

| II | Form PT (Income Tax) | Submission of the final Income Tax Return Form. | All Form PT submissions must be up-to-date, including the final year of assessment up to the date of cessation of business. |

| III | Form E (Employer) | Submission of the final Employer Return Form. | Must be submitted up to the final year of remuneration, even if there were no employees. |

The LHDN will issue the clearance letter only after confirming all taxes, audit cases, and penalties (if any) are fully settled.

Written notice from the IRBM – LLP

Step 3: Statutory Notices and Publications (Section 50(4) of the LLP Act)

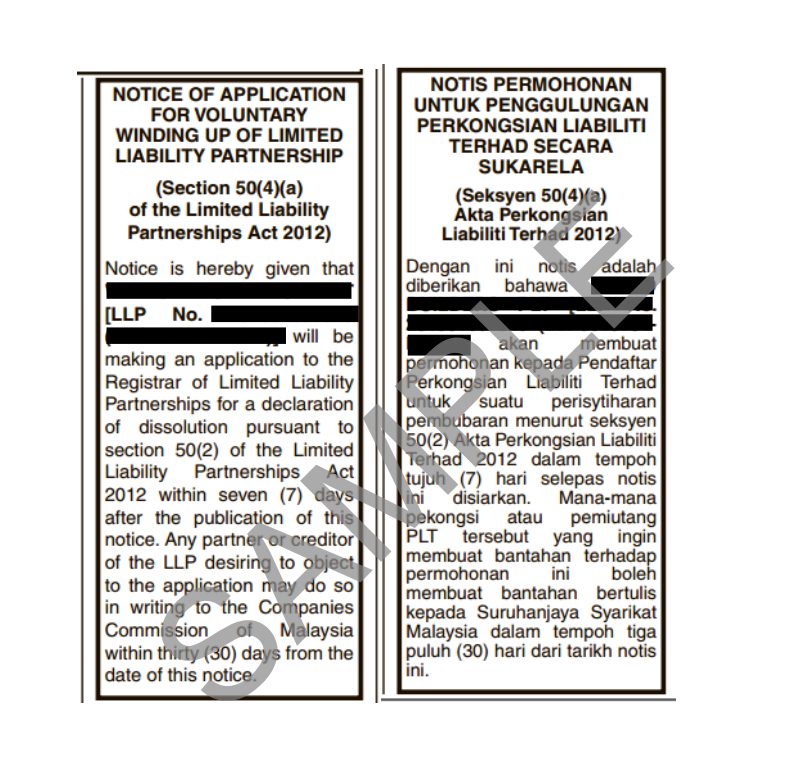

With tax clearance in hand, the LLP must publish its intention to dissolve:

- Notice to Partners: Send a formal written notice of the intended application to all partners via registered post to their last known address.

- Public Notice (Newspapers): Publish the dissolution notice in at least one widely circulated national language (Bahasa Melayu) newspaper and one English language newspaper.

Publication of notice in the newspapers of Dissolution of LLP

Step 4: Formal Application to SSM (The Registrar)

The application must be submitted to the Registrar of LLPs (via the MyLLP online portal) within 7 days from the date of the notice to partners or the newspaper publication, whichever is the later.

The final application package typically includes:

- The prescribed online application form (e.g., VW101 – Notification of Declaration of Dissolution).

- The Tax Clearance Letter (No Objection Notice) from LHDN.

- A copy of the notice sent to partners (with proof of registered post/receipt).

- Copies of the newspaper publications.

- A Statutory Declaration (SD) by a partner, affirmed before a Commissioner for Oaths, confirming the LLP has ceased operation, paid all debts, and has no remaining assets or liabilities.

Step 5: Registrar’s Review and Declaration

- 30-Day Public Notice: If the Registrar is satisfied, they will publish a 30-day notice on the SSM website, allowing creditors or partners to file an objection.

- Dissolution: If no valid objection is received after 30 days, the Registrar will issue the Declaration of Dissolution.

- Final Requirement (VW107): The LLP must then submit Form VW107 (Notice of Completion of Distribution) to the Registrar within 14 days after any surplus assets have been distributed. The LLP is formally dissolved only upon the Registrar receiving this notification.

The entire process takes typically 3–4 months, depending on tax clearance and statutory notices.

Post-Dissolution Statutory Obligation

Under the LLP Act, all partners must ensure that the LLP’s accounting records and other statutory documents are kept safely for a period of seven (7) years from the date of dissolution. Failure to comply is an offence under the Act.

The winding-up process is procedural and requires strict compliance with all statutory timelines, particularly the clearance of tax liabilities with LHDN before the application to SSM.

Need Professional Assistance?

Navigating the winding-up process can be complex, especially when dealing with statutory filings, tax obligations, and potential disputes. POSH Corporate offers end-to-end support, including:

- Preparing all required documents and resolutions.

- Liaising with SSM for filings and approvals.

- Coordinating all final tax submissions and managing the LHDN clearance process.

- Ensuring proper closure of the LLP tax file.

With our guidance, you can ensure your LLP is dissolved efficiently, compliantly, and with minimal stress.